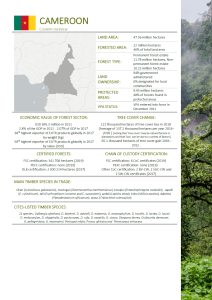

FORESTRY SECTOR IN CAMEROON

Cameroon’s forests are mainly tropical rainforests of two predominant types: lowland evergreen (54% of total forest area), and lowland semi-deciduous (28%). The evergreen forests can be divided into two broad categories:

- The Biafran forests, a low altitude coastal forest along the Gulf of Guinea, and the

- Congo Basin forests in Cameroon’s south and southeast.

Biafran forests have been largely cleared, but where it still exists, it is characterised by species such as Azobé (Lophira alata) and Ozouga (Sacoglottis gabonensis).

The composition of species in the Guinean-Congolese forests differs significantly from that of the Biafran forest due to the absence of gregarious Caesalpiniacae, with the notable exception of the Limbali (Gilbertiodendron dewevrei). Another characteristic is the significant number of Moabi (Baillonella toxisperma). Other commercial tree species harvested include Sapelli (Entandrophragma cylindricum) and Sipo (Entandrophragma utile) and Ayous (Triplochiton scleroxylon). The dense semi-deciduous medium-altitude forest is characterised by its abundance of Sterculiaceae. They are particularly rich in species that lend themselves to peeling (FAO).

The Forest Law (1994) divides the forest area into non-permanent (domaine forestier non-permanent), including community forest and private forest, and permanent (domaine forestier permanent) forest areas. The permanent forest includes forest reserves, logging concessions, protected areas and council forests. Protected areas, including national parks, forest reserves and hunting zones, currently cover 20 per cent of the national forest area. (WRI, 2017).The permanent forest areas are owned by the state, although for a large part of this forest area the management rights are transferred to other parties. Generally, people living in forest areas fully retain their traditional user rights.

In the non-PFE (domaine forestier non-permanent) non-allocated lands are mainly used by local communities for farms and other purposes, and allocation of these lands to communities shall follow formal procedures. However, disputes over forest ownership and the demarcation of boundaries have been common in the past and remain so today (ITTO, 2011).

PRODUCTION AND EXPORT

In 2019, MINOF declared 93 forest concessions, 38 communal forests, 142 timber sales and approximately 50 community forests. These forest titles are managed by about 50 large international or national companies (59), about 40 medium-sized national companies (46) and about 30 rural communes (38) that own communal forests (I2D, 2019).

According to MINFOF (2018), Cameroon’s logging industry produced approximately 3.3 million metres of logs in 2017. Most of this volume is used for the export of products from primary processing, which represents a total export value of US$933.7 million in 2018 (ITTO 2019, data 2018).

Although the majority of the logs are processed within the country, the production of highly processed products is still relatively rare. The forest industry mainly produces primary timber products, with the main export products being logs, sawnwood, plywood and veneer.

The most harvested species between 2010 and 2016 (FRMi 2018) are:

- Ayous (Triplochiton scleroxylon)

- Sapelli (Entandrophragma cylindricum)

- Tali (Erythrophleum ivorense; Erythrophleum suaveolens)

- Azobé (Lophira alata)

- Okan (Cylicodiscus gabunensis)

- Iroko (Milicia excelsa)

- Padouk (Pterocarpus soyauxi)

- Kossipo (Entandrophragma candollei)

- Fraké (Terminalia superba)

- Dabéma (Piptadeniastrum africanum)

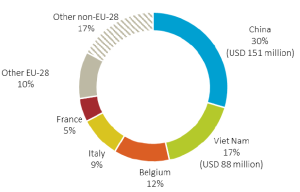

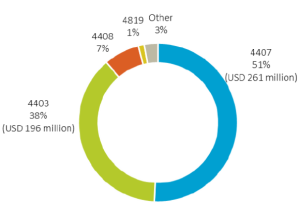

In 2017, exports of European Union Timber Regulation (EUTR) -regulated products (timber and timber products to which the EUTR applies) from Cameroon totaled USD 516 million, of which 36% was exported to the EU-28, according to data from the UN Comtrade Database. Cameroon exported EUTR products to 81 different countries and territories. The main global markets for Cameroon’s EUTR products in 2017 by value were China and Viet Nam. The main EUTR products exported from Cameron by HS code according to value in 2017 were sawn wood (HS 4407) and rough wood (HS 4403)

Main global markets for EUTR products from Cameroon in 2017 in USD

Main EUTR products exported from Cameroon in 2017 by HS code according to value in USD.

Produced using data from the UN Comtrade Database

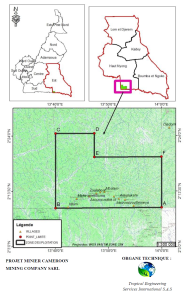

The Forest comprise a montane tropical moist broadleaf forest ecoregion and consists of 760 Square Kilometer (New York city is 780 Square Kilometers). This area encompasses a chain of extinct volcanoes with elevations above 900 meters, and contains iron ore deposits.

The Mbalam Forest located in south-east Cameroon in the East Region. Mbalam represents one of the largest iron ore reserves in Cameroon and in the world having estimated reserves of 800 million tonnes of ore grading 62% iron metal.

LOCATION OF THE NGOYLA EASTERN AND SOUTHERN REGION

DEPARTMENT OF UPPER NYONG AND DJA AND LOBO

DISTRICT OF NGOYLA AND MINTOM

MBALAM Harvesting Program

GreenTrees World, in collaboration with its local partners, aims to responsibly harvest 10,000 square kilometers of forest and extract timber valued at over USD $250 million. Following the extraction process, GreenTrees is committed to working closely with local communities to implement a comprehensive reforestation program. This initiative seeks to rejuvenate the forest ecosystem for the benefit of future generations.

As part of our commitment to sustainability, GreenTrees will provide training to local residents in establishing nurseries and effectively planting trees. By empowering locals with the necessary skills, we aim to ensure the long-term health and vitality of the forest.

When mining operations conclude, strategic reforestation programs can rejuvenate the mined areas, restoring them to their natural habitat. Such initiatives are pivotal in curbing soil erosion, fostering a robust and diverse ecosystem conducive to the flourishing of indigenous flora and fauna, and providing employment opportunities for local communities.

The selection of native species well-suited to the local climate is paramount, ensuring resilience and sustainability. Planting methods vary, encompassing both manual labor and mechanized techniques, while the scattering of seeds further aids in ecosystem restoration. Attention to detail, including precise spacing and optimal planting depths for saplings and seeds, is essential for successful growth and ecosystem recovery.

Involving the mining community in the reforestation process not only fosters a sense of stewardship but also generates employment opportunities for those previously engaged in mining activities.

When mining operations conclude, strategic reforestation programs can rejuvenate the mined areas, restoring them to their natural habitat. Such initiatives are pivotal in curbing soil erosion, fostering a robust and diverse ecosystem conducive to the flourishing of indigenous flora and fauna, and providing employment opportunities for local communities.

The selection of native species well-suited to the local climate is paramount, ensuring resilience and sustainability. Planting methods vary, encompassing both manual labor and mechanized techniques, while the scattering of seeds further aids in ecosystem restoration. Attention to detail, including precise spacing and optimal planting depths for saplings and seeds, is essential for successful growth and ecosystem recovery.

Involving the mining community in the reforestation process not only fosters a sense of stewardship but also generates employment opportunities for those previously engaged in mining activities.

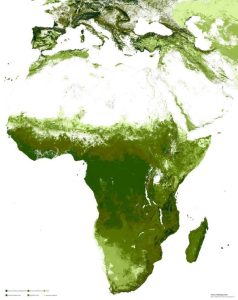

Africa is home to vast tracts of forested land, including tropical rainforests, savannas, and woodlands. These natural resources present significant opportunities for timber production and other forest-based industries.

Africa is renowned for its rich biodiversity, including many unique and endangered species that rely on forest habitats. Investing in forestry projects that promote sustainable management and conservation can help protect biodiversity hotspots while generating financial returns.

African forests play a crucial role in mitigating climate change by sequestering carbon dioxide from the atmosphere. Investing in projects that protect and restore forests can contribute to global efforts to combat climate change, potentially attracting support from international climate finance initiatives.

Investing in forestry projects can offer several benefits, both financial and environmental:

- Diversification: Forestry investments provide diversification within an investment portfolio. Timberland often behaves differently from traditional financial assets like stocks and bonds, so it can help reduce overall portfolio risk.

- Steady Returns: Timber investments typically offer stable, long-term returns. Trees grow steadily over time, providing a predictable revenue stream from timber harvesting.

- Inflation Hedge: Timberland can act as a hedge against inflation. Timber prices tend to rise with inflation, providing a natural buffer against the erosion of purchasing power.

- Environmental Benefits: Investing in forestry projects can contribute to environmental conservation and sustainability. Well-managed forests provide habitat for wildlife, protect watersheds, and absorb carbon dioxide from the atmosphere, helping mitigate climate change.

- Social Impact: Forestry investments can have positive social impacts by providing jobs in rural communities and supporting local economies.

- Tangible Asset: Timberland is a tangible asset with intrinsic value. Unlike financial derivatives or securities, it’s a physical asset that retains value even during economic downturns.

Long-Term Growth: Trees typically take several years to reach maturity, so forestry investments require a long-term perspective. However, this long-term growth potential can lead to significant returns over time.

Overall, investing in forestry projects in Africa can provide a unique combination of financial returns, environmental conservation, social impact, and sustainable development, making it an attractive option for investors seeking opportunities in emerging markets.